By all accounts, 2021 was an exceptional year. Emerging from a global pandemic still felt from the previous year and finishing the year stronger than expected.

Download the full year Augustus Media – Annual Financial Report 2021 here.

When the pandemic hit back in early 2020, our business as well as well as the expert analysts forecasted the impact of covid-19 will persist for at least two years. This was a concern, as our revenue dropped by 80% at some point between March and April, businesses continued to struggle throughout the entirety of 2020 and beginning of 2021. Our expectations based on the news circulated in the market in early 2021 is that we should expect a year identical to 2020.

Commercially we forecasted annual gross revenue targets at $4m, which puts us close to 40% increase against 2020. These projections changed much quicker than anticipated, by end of H1 our top line figures surpassed our forecast, by Q4 our Gross Revenue forecast reached to $5.5m, a 38% increase from the original forecast set in early Q1.

We continued to grow our top line and bottom line at an accelerated pace, the expansion plans we had set pre-pandemic became more likely towards end of H1. We went from a business that is riding the wave along with the rest, to leading the tide.

The business continued to focus on long-term sustainability and plans to reduce cost while achieving high performance. Augustus Misr, came into the picture by the start of H2, as we struggled to outsource tech developers and content writers – a plan to initiate an in-house tech & content hub for the region emerged. The decision to launch Augustus Misr came at a perfect time, developing existing platforms as well as introducing new products gave the business an upper edge.

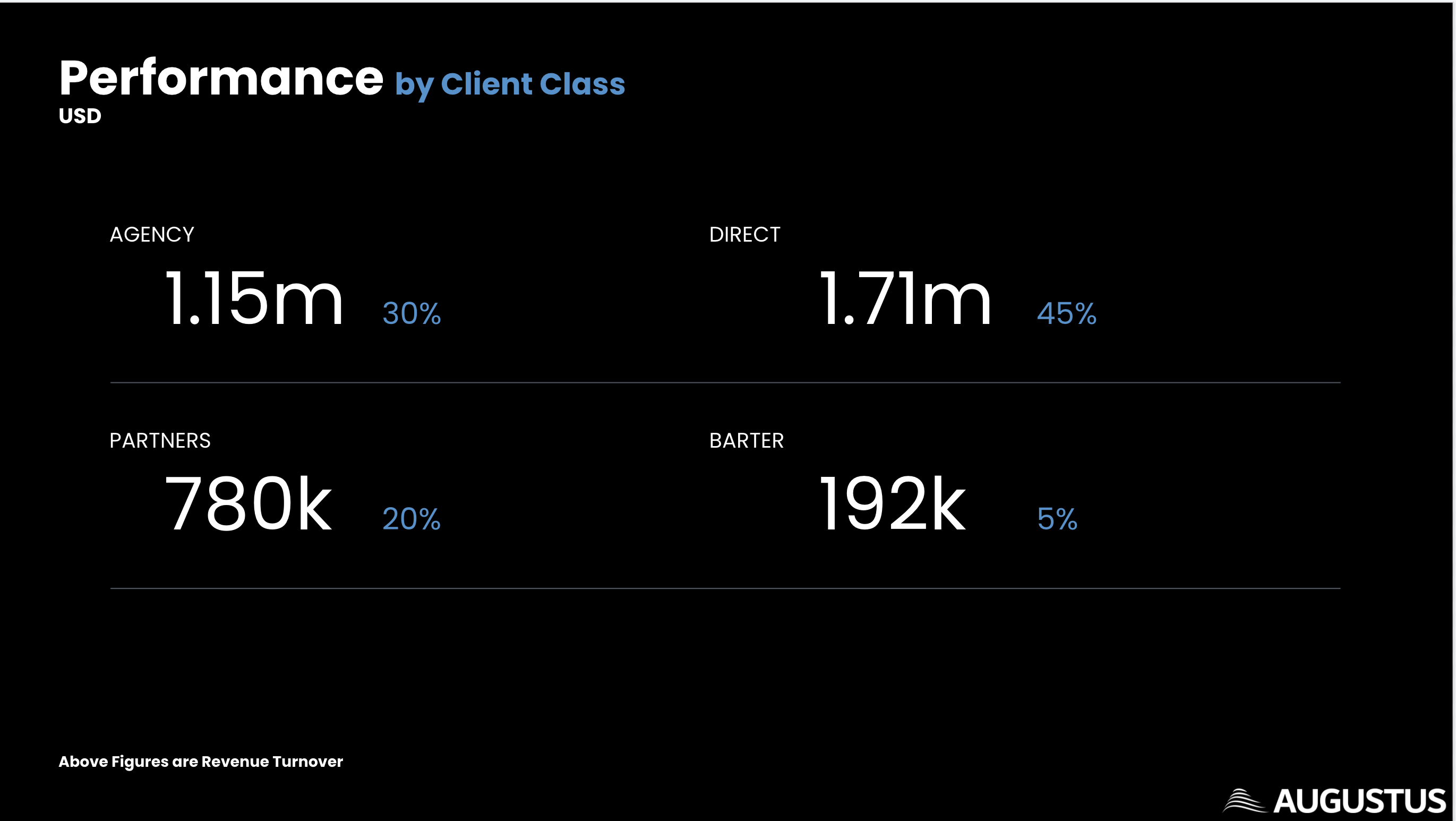

Content revenue picked up pace, with the support of our Advertising revenue which was introduced mid 2020 ended to play 20% of our total Revenue share in 2021. The substantial growth within these two revenue streams allowed us to double our previous year Gross Revenue.

Agency revenue came back into play late Q1 after all their clients paused all their budget since March 2020. This revenue was close to lost for as long as 11 months, an illustration of how Augustus is un-reliant on a single client type. Direct client revenue has been the most secure source of revenue since the establishment of the business back in 2015, and will remain this way. Revenue earned from Agency, Advertising Partners, and Direct to Consumer will allow the business to overachieve its annual target year on year, as we have only tapped a minor percentage of the revenue share available in the market.

2021 was a key focus to setup our company pillars to what we expect in the next 4 years to come. It has been estimated that Augustus will achieve $11m in Net Revenue, $15m Gross by end of 2025, the following forecast is based on a sustainable year on year growth on 33%, a goal we are likely to overachieve in a shorter period of time.

2022 has started strongly, well in line with our latest three-year plan to triple our revenue organically in the next three years.

We opened our doors to our new Headquarters in Dubai as well as signing an office expansion for our Cairo office. These initiative give us a head start to our 4 year plans, and put us inline with the company’s long term objectives.

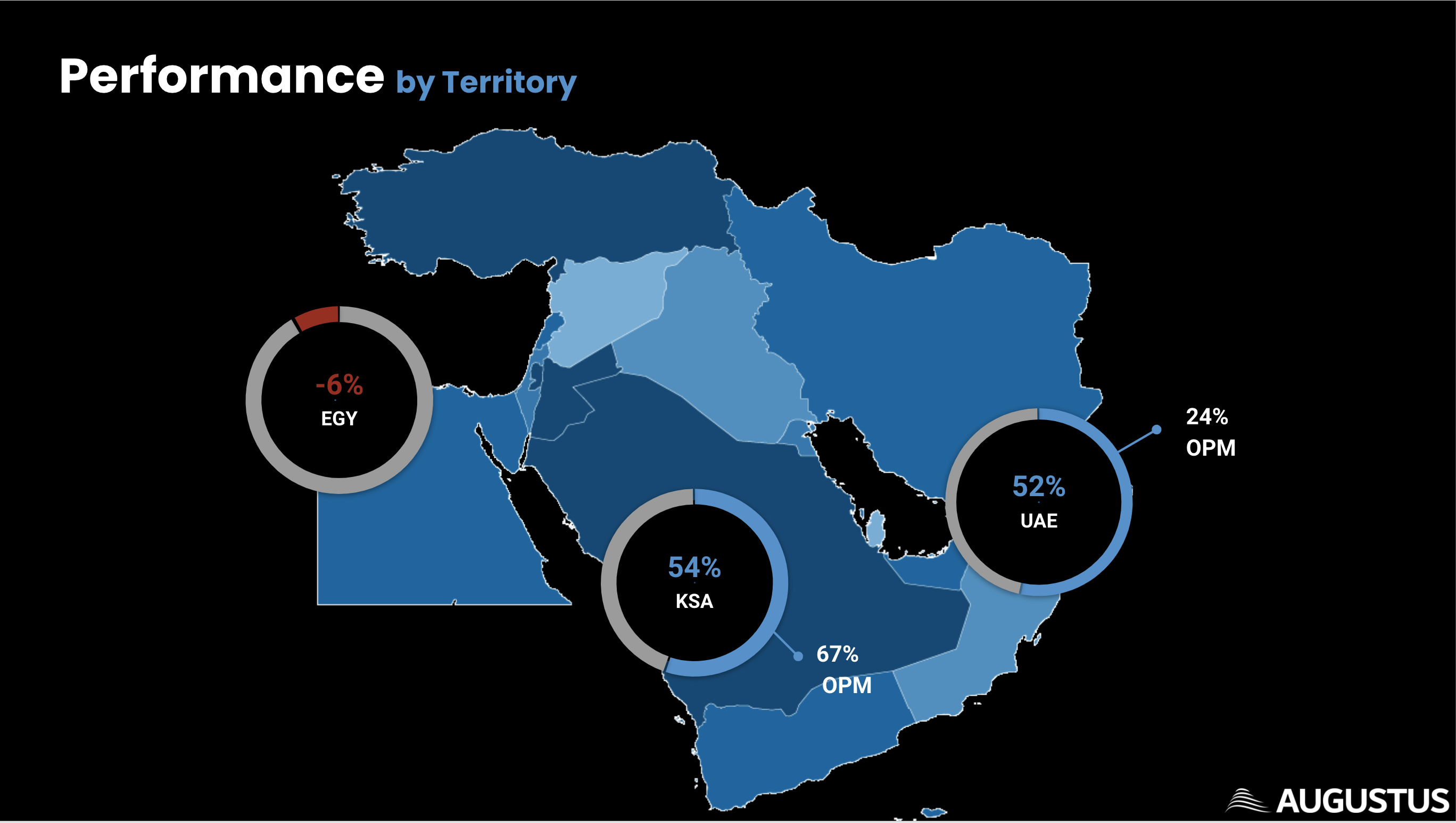

The next 4 years will be focused on exploring new territories, whether through self established subsidiaries or through joint ventures which will allow the Lovin brand to reach over 10 different countries, and more than 20 different cities by the end of 2025. Headcount wise we look to have 120 employees working across the region.

Our strategy is to have core Augustus Media entities in Dubai, Riyadh and Cairo, operating a JV model with ‘lovin’ in cities in other countries.

Focus on youth Audiences, millennial and gen z, with brand IP’s, and ‘non scripted’ content on text, audio and video.

Both brands will progress the linear and on demand live cloud based production.

Commercially, our focus will be on the 3 main revenue stream buckets:

- Advertising & Creator economy – audience, social, video revenue,

- Branded content,

- Direct to consumer – subscription and token economy,

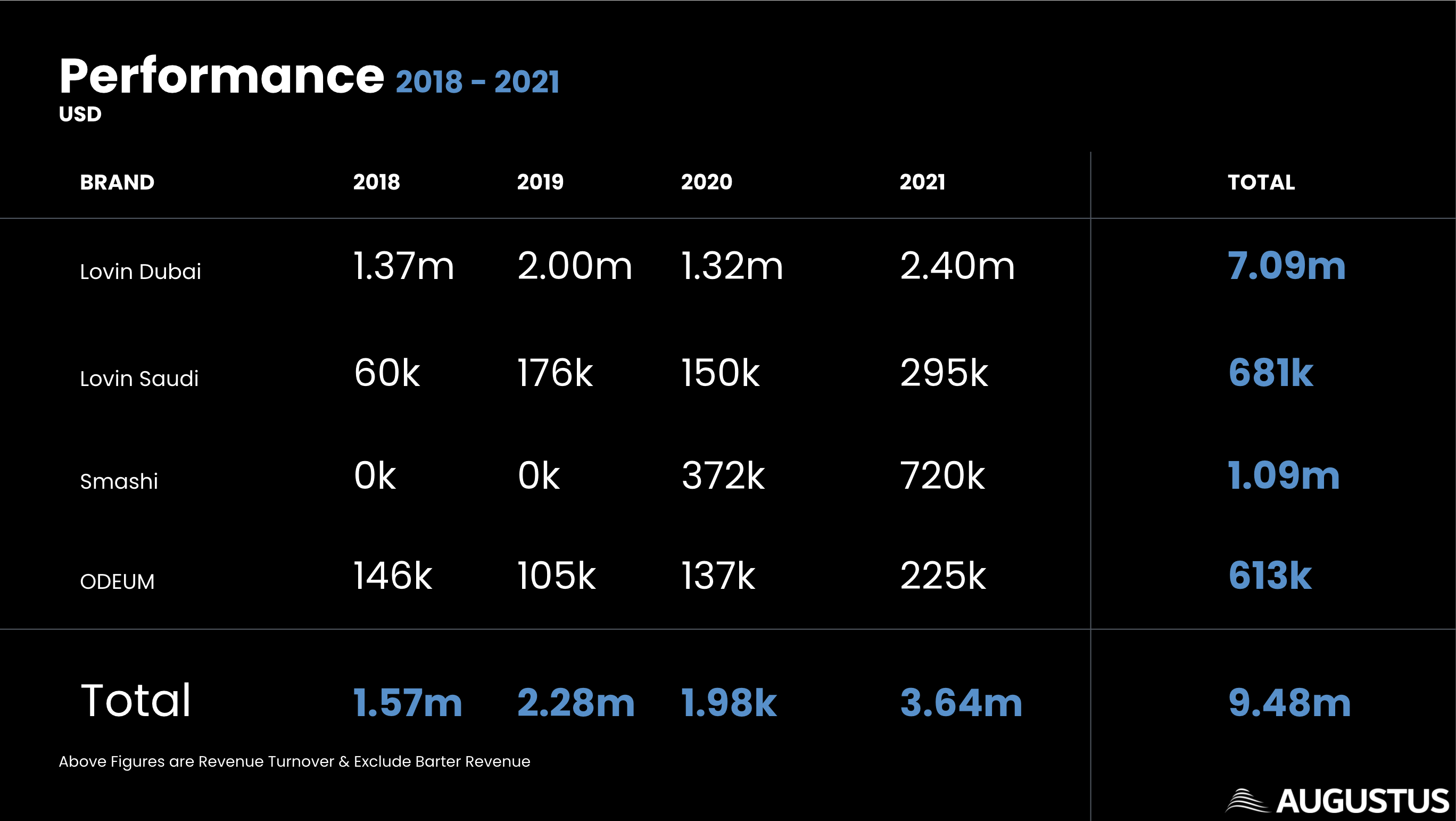

Financial Performance

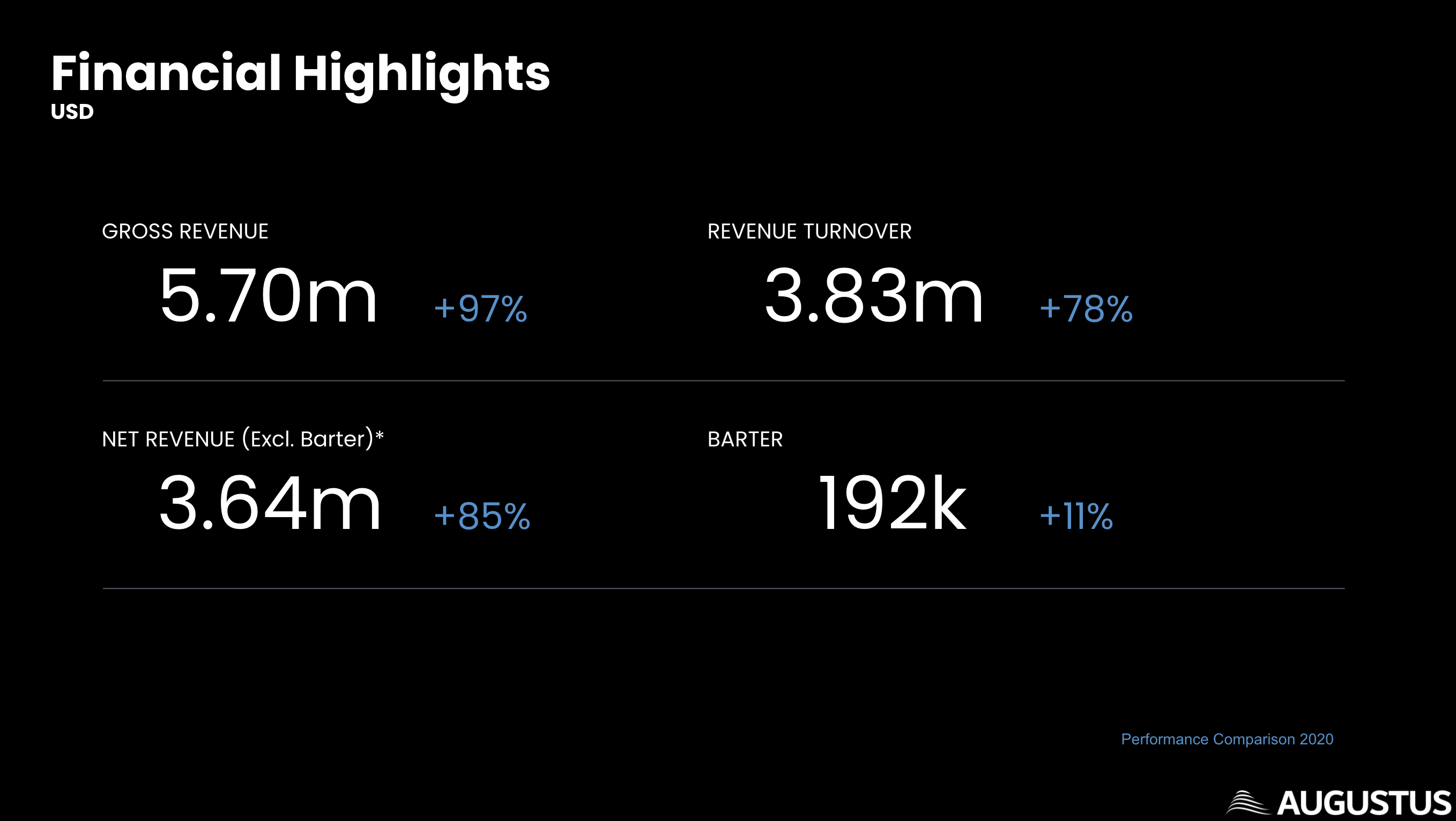

Gross Revenue: $5.70 million, up 97% from previous year, up 7% from latest targets and up 40% from original targets.

Revenue Turnover: $3.83 million, up 78% from previous year, up 1% from latest targets and up 19% from original target.

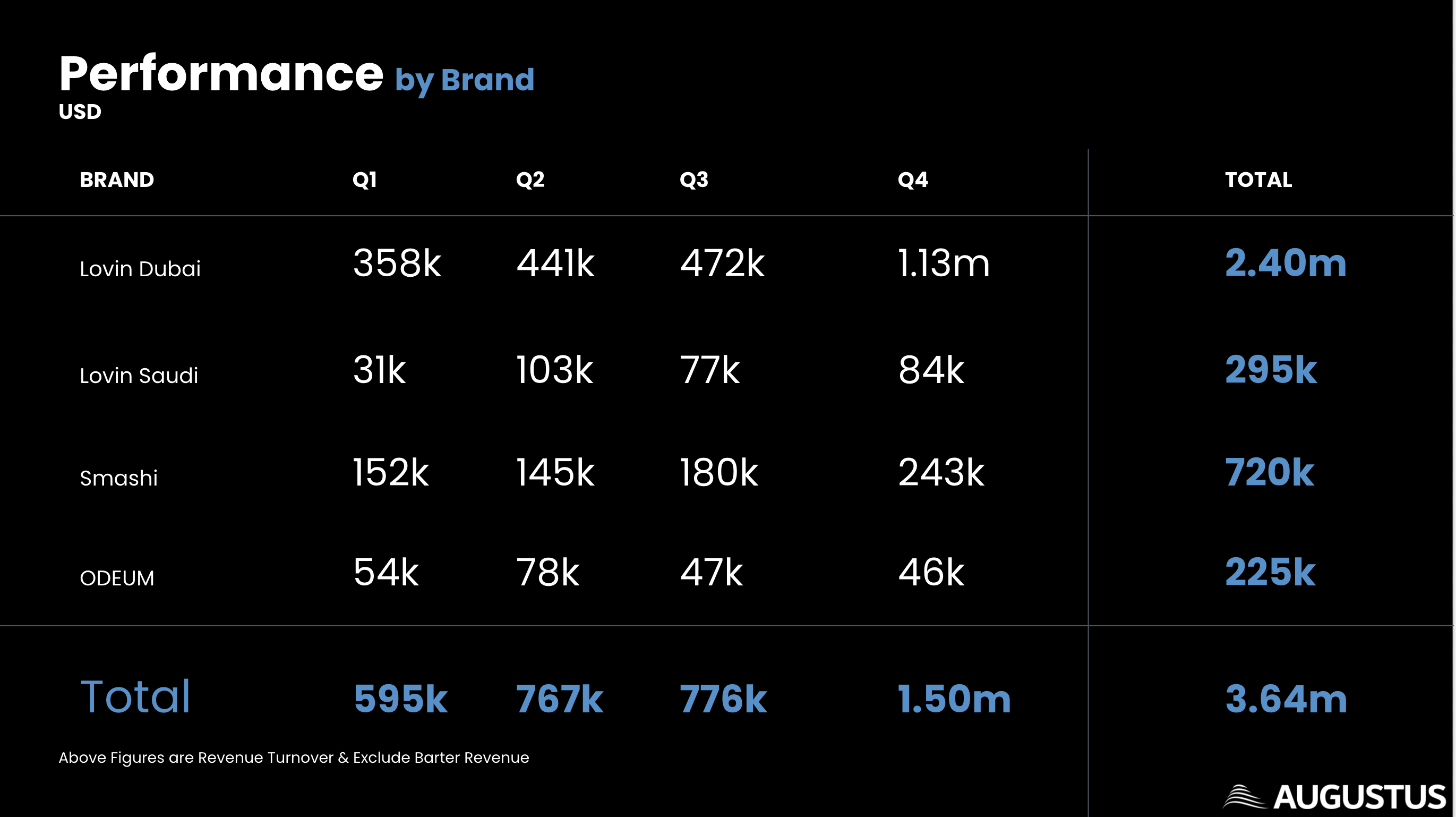

Net Revenue: $3.64 million, up 85% from previous year, up 5% from latest targets and up 23% from original targets.

Barter: $192 thousand, up 11% from previous year, down 39% from latest targets and down 29% from original targets.

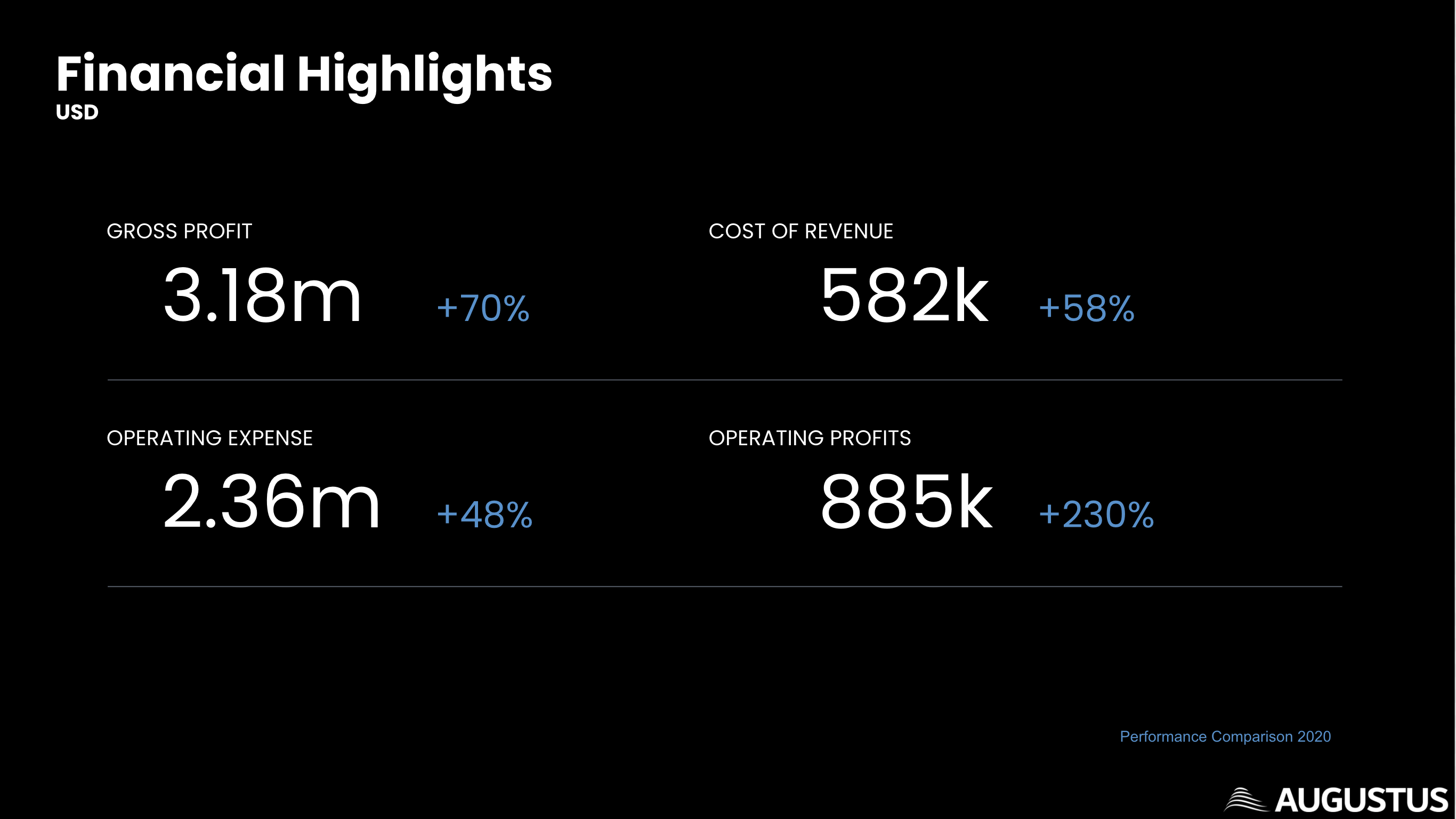

Gross Profit: $3.18 million, up 70% from previous year, down 3% from latest targets and up 15% from original targets.

Cost of Revenue: $582 thousand, up 58% from previous year, up 15% from latest budgets and up 23% from original budgets.

Operating Expense: $2.36 million, up 48% from previous year, up 5% from latest budgets and in-line with original budgets.

Operating Profits: $885 thousand, up 230% from previous year, down 12% from latest targets and up 125% from original targets.